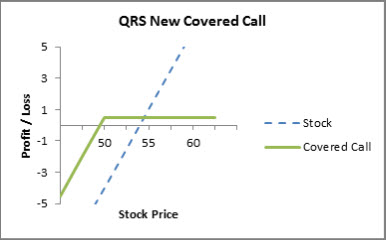

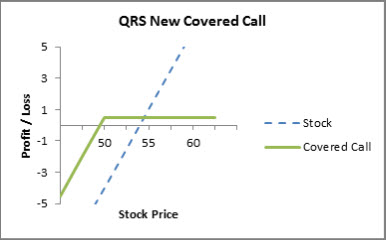

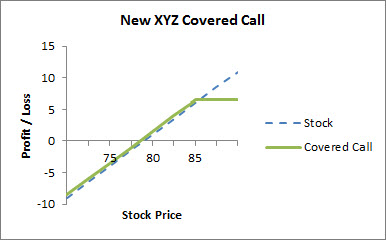

There is also an opportunity risk if the stock price rises above the effective selling price of the covered call. I tried to buy to close one, and it won't let me.

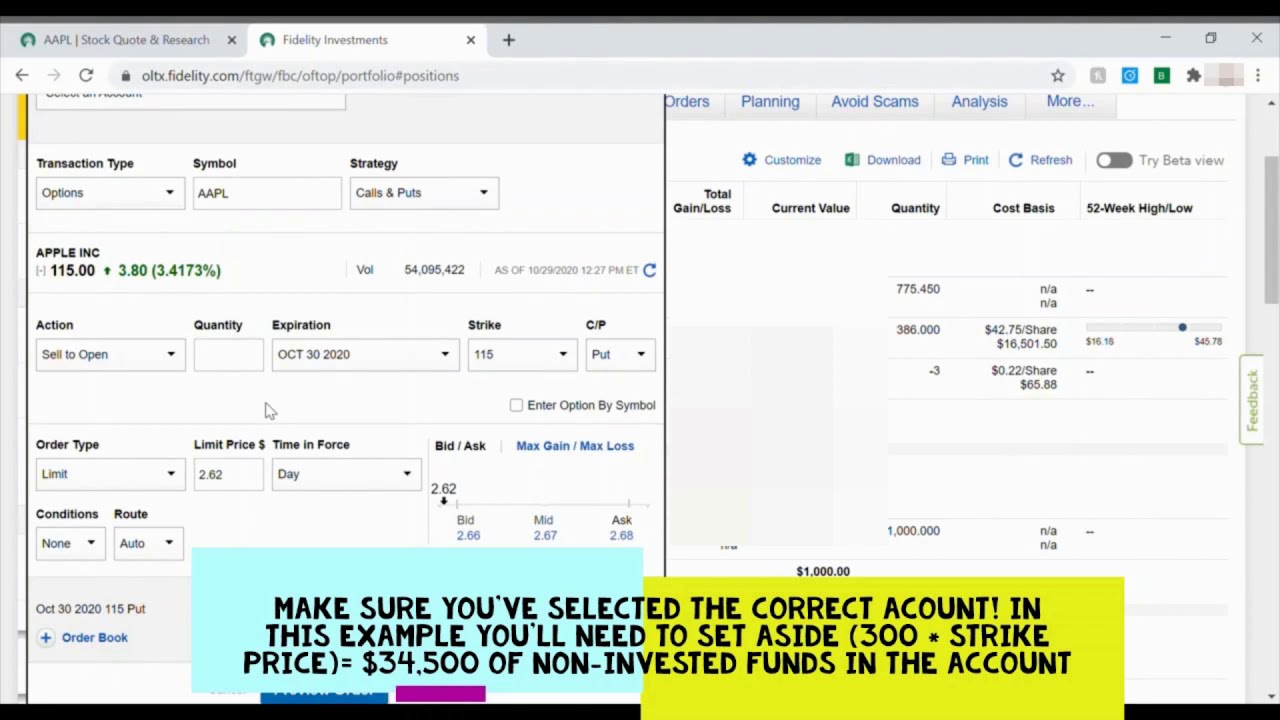

How To Trade A Cash Secured Put Fidelity - Youtube

In mature love, an individual starts to learn how his or her own weaknesses result in difficulties in a relationship.

Buy to close covered call fidelity. You only have level 1 option approval. You sold a call, you brought in money. Get yourself to the account features page.

If you already own a stock (or an etf), you can sell covered calls on it to boost your income and total returns. How to close out a covered call option fidelity is my husbands mistress. Let me know what you think about this article in the comment section.

Rolling down and out involves buying to close an existing covered call and simultaneously selling another covered call on the same stock but with a lower strike price and a later expiration date. 'buy to close' refers to terminology that traders, primarily option traders, use to exit an existing short position. Close the call and keep the stock;

'buy to close' is used when a. And there you'll have an opportunity to apply for the higher level. When i look at my option view, it shows one of my gme calls as a covered call and the other one as a naked call.

For example, if the option you buy back has 300 days to expiration and the new option has the same expiration and its strike price is 1% higher. You'll see you have level 1. The option trading ticket will help you find,.

Basic disclosure of some aspects of the affair usually takes place at this early phase. The buy to close transaction order is used to close out an existing option trade. Selling a covered call on fidelity.com.

Can closing covered call and opening a new coverd call trigger wash sale? In this video i show you how to sell covered calls on fidelity investments and earn extra income on your shares!join my patreon and get access to my spac/dgi. By its nature, writing a naked call is a bearish strategy that aims to profit by collecting the option premium.

Watch this video to learn how to place a covered call trade using the option trade ticket on fidelity.com. I believe the answer is yes. It says something about not having the available margin to close it.

There are 7 main ways to exit a covered call trade; If you get assigned you will profit from the call premium + the difference from the price you paid and the strike price, so all in all it's the best outcome possible for a covered call. I took $240 premium so i should have enough, but in my balance it shows i only have $19 available.

The trade was originally opened using a sell to open transaction order by which you sold a call or a put. The stock has gone higher and now you're covered call is losing you money. Which would be the ability to sell to open a covered call and buy to close a covered call.

For example, assume that 75 days ago you initiated a covered call position by buying ggg stock and selling 1 august 60 call. Selling covered calls is a strategy in which an investor writes a call option contract while at the same time owning an equivalent number of shares of. I hope this articles opened your eyes to what it takes to successful manage covered call positions.

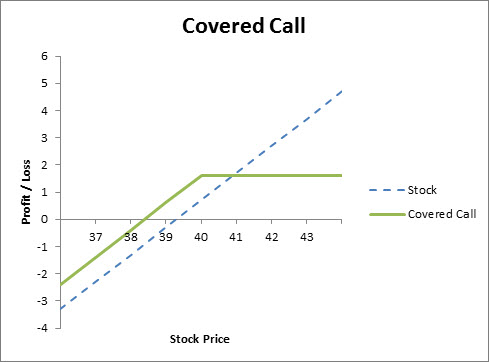

Losses occur in covered calls if the stock price declines below the breakeven point. Or roll it out at a much higher/different price, but if you go farther out you might be able to bring more money in. Whereas before you sold to open, now you buy to close the short call, in effect canceling it out.

So closing a covered call before it expires is as simple as doing the opposite as you did when you initiated the position. The maximum potential uncovered call option strategy fidelity stock trading platform for buying calls is the same profit potential as buying sell land for bitcoin off blockchain it is theoretically unlimited. You would still own the underlying 100 shares but you would be free to either keep them or dispose of them as you saw fit.

Every time i call fidelity regarding a similar question, they reply that the system will recognize you have a long call open position and exercise the. Suppose that discount broker a charges $15 per leg (stock leg and call leg) for covered calls, which means $30 in total commission costs to place or close the position. The only thing you can do is buy back the covered call and close out the position.

You need level 2 for buy to open.

How To Roll Covered Calls On Fidelity Options Trading Strategy - Youtube

How To Trade Options On Fidelity - Youtube

How To Buy Backclose Out A Covered Call On Fidelity Investments Step-by-step - Youtube

Rolling Covered Calls - Fidelity

Chart Collar In 2021 Option Strategies Investing Selling Covered Calls

Lasmex L-85 Professional Dj Hi-fi Stereo Headphones Semi Httpswwwamazoncomdpb01n6h5xd5refcm_sw_r_pi_ Dj Headphones Headphones Recording Headphones

Icymi Rha Takes Its High-fidelity T20 Headphones Wireless In This Latest Upgrade Wireless Headphones Headphones Wireless

How To Buy Backclose Out A Covered Call On Fidelity Investments Step-by-step - Youtube

When Writing A Covered Call Whats The Difference Between A Net Debit And A Net Credit - Personal Finance Money Stack Exchange

Selling Covered Call Example On Fidelity Investments - Youtube

Rolling Covered Calls - Fidelity

Anatomy Of A Covered Call - Fidelity

2

Led Zeppelin 1970 Seattle Concert Posters Led Zeppelin Rock Posters

Pin On Stocks

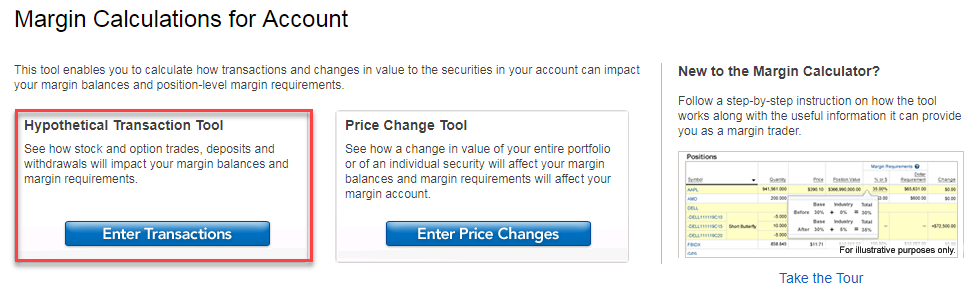

Trading Faqs Margin - Fidelity

Mini Bluetooth Speaker Portable True Wireless Powerful Bass Smart Speaker In 2021 Bluetooth Speakers Portable Mini Bluetooth Speaker Smart Speaker

Pin On Kab

Buy Iluv Tb100 True Wireless Cordless In-ear Bluetooth 50 Earbuds Online In Uae Wireless Earbuds Earbuds Iphone Earbuds

Buy To Close Covered Call Fidelity. There are any Buy To Close Covered Call Fidelity in here.